Ololade Adeyanju

With the current economic recession and the attendant high cost of living, a deal that promises great financial returns is one most people are likely to fall victim to.

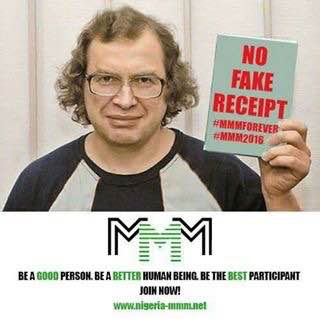

Nigeria has had its fair share of schemes that promise quick returns to the first investor from money invested by later investors such as the Mavrodi Mondial Movement (MMM).

Owing to the huge popularity of MMM among Nigerians, several other Ponzi-styled schemes have sprang up, promising investors incredible returns.

And even the seeming collapse of MMM in Nigeria, with the potential loss of estimated billions of naira by investors, have not reduced the appetite of Nigerians for the easy money promised by these bogus schemes.

According to 2015 international reports, at least 61 Ponzi schemes were uncovered globally that year, with a total close to $1billion in potential losses.

But how can you actually tell if it is a good investment or if it’s just another gold-coated Ponzi scheme?

Financial experts have now identified the peculiarities of Ponzi schemes, which potential investors should be wary of.

These include: Promises of high returns within a short period, “success” stories of how much money existing members have made, statements such as “an opportunity of a lifetime”, lack of clarity around underlying investments, very high initial returns and encouragement to invest more and sale of unregistered products.

Experts also noted that retirees are the most common victims of Ponzi schemes. Other potential victims include young people heading families and the unemployed.

According to them, the problem comes in when retirees realise that they may not have enough money to last throughout their retirement and are therefore more susceptible to promises of high investment returns.

Regardless of your age or the current situation in your life, it is important to take a cautious approach and not to be lured by false promises, experts warned.

Wouter Fourie of the Financial Planning Institute in South Africa says these schemes will “hook” a person first before it all turns sour.

“It works the first time, and the second time and then suddenly we take it as that this is the norm. It then becomes easy to sell it to friends and family,” Fourie noted.

0