Ololade Adeyanju/

The Central Bank of Nigeria (CBN) has clarified the new charges it introduced under the its cashless policy following the huge outcry that greeted the announcement.

The CBN had announced that starting from Wednesday September 18, banks in Nigeria should start charging customers on Deposits and Withdrawals from N500, 000.

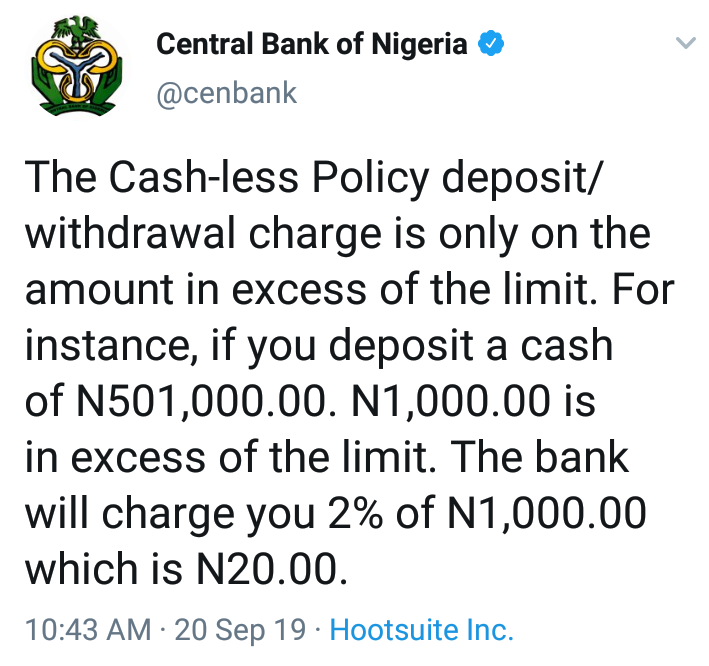

But in tweet via its verified Twitter handle, @cenbank, today, it explained that deposit/withdrawal charges apply only to the amount in excess of the limit and not the entire deposit.

The tweet stated: “The Cash-less Policy deposit/withdrawal charge is only on the amount in excess of the limit. For instance, if you deposit a cash of N501,000.00. N1,000.00 is in excess of the limit. The bank will charge you 2% of N1,000.00 which is N20.00.”

In another tweet, the Central Bank said it would make further clarifications on the issue via live webcast at 2.15pm today.

“Visit https://t.co/aVFCabsTzS for live webcast of the Monetary Policy Committee decisions at 2:15pm (Nigerian time) today, September 20, 2019,” the tweet read.

While making the announcement on Tuesday, the Central Bank said that the nationwide implementation of the cashless policy would begin by March 2020.

It noted that implementation of the policy would signal the imposition of charges on deposits in addition to already existing charges on withdrawals.

According to the circular, the charges will attract three per cent processing fees for withdrawals and two per cent processing fees for lodgments of amounts above N500,000 for individual accounts.

For corporate accounts, the apex bank in the circular said that deposit money banks (DMBs) would charge five per cent processing fee for withdrawals and three per cent for lodgments of amounts above N3million.

The statement, however, disclosed that the charge on deposits would only apply in Lagos, Ogun, Kano, Abia, Anambra, and Rivers states as well as the Federal Capital Territory.

0