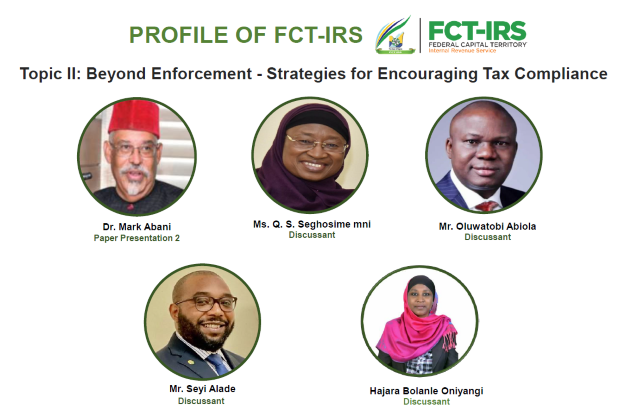

Mr. Tobi Abiola, the Director, Tax Investigation Department, Federal Inland Revenue Service presented a paper titled ‘Beyond Enforcement: Strategies for Encouraging Tax Compliance’ on Tuesday during a Tax Seminar held by the Federal Capital Territory Internal Revenue Services (FCT-IRS) at NAF Conference Centre, Jahi, Abuja.

Introduction

The primary goal of a revenue authority is to collect taxes and duties payable in accordance with the law and to do this in such a manner that will sustain confidence in the tax system and its administration. The actions of taxpayers, whether due to ignorance, carelessness, recklessness, or deliberate evasion, as well as weaknesses in a tax administration mean that instances of failure to comply with the law are inevitable. Therefore, tax authorities should have in place strategies and structures to ensure that non-compliance with tax law is kept to a minimum.

Compliance

Compliance in taxation means that taxpayers have met their legal obligations under the tax laws and includes ensuring that all tax returns are submitted, and tax liabilities paid. Compliance activities include but are not limited to:

•Registration with the tax authority

•Timely filing of returns

•Reporting of complete and accurate information (record keeping); and

•Payment of tax obligations on time.

Enforcement

Enforcement involves compelling taxpayers to adhere to or obey the provisions of the relevant tax laws. It includes activities such as:

•Search and seizure

•Distrain on property or goods

•Prosecution of tax defaulters for recovery of tax

•Placing of lien on tax defaulters’ bank accounts.

Strategies to Encourage Compliance

- Reward Compliance

Businesses have ways of rewarding their best customers. Such rewards come in form of frequent-flyer miles, coupons, special discounts, free gifts, and so on. Those strategies build customer loyalty and create a favorable impression of the business. Tax authorities can adopt a similar approach by giving tax bonuses to early filers on the amount of tax paid which could be available as a credit against future tax payments. This is supported by Section 77 (5) of the Companies Income Tax Act, (as amended).

2. Tax Accountability – Show what Taxpayer’s money is used for

Taxpayers want to know what they get in return for the taxes they pay. They sometimes see signs on highway construction that read ‘‘Your Tax Money at Work.’’ For the most part, the individual taxpayer’s psyche is that his tax money is being used judiciously and this may encourage compliance.

3. Provide Meaningful Customer Service

When employees of tax authorities provide helpful and correct information to taxpayers, it may also encourage compliance. This can be done by way of advertisements, flyers, pamphlets, etc.

4. Selectively Publicize Enforcement

Selective publicity about specific tax evasion activities, in contrast with enforcement, makes compliance easier to achieve. For instance, naming and shaming of recalcitrant late filers or nil filers in the dailies, as opposed to search and seizure or distrain on defaulter’s property can encourage voluntary compliance.

5. Effective Communication Strategy

This refers to the various way by which taxpayers and other stakeholders are informed of new developments in taxation. The strategies include access to real-time help on tax matters, access to information, access to customer care that can help taxpayers online in real-time when the need arises, and publishing informative booklets aimed at providing taxpayers specific information on the applicable taxes and changes to tax laws, etc.

6. Use of the Media

The tax authorities should continue to make use of the media to educate taxpayers on filing/due dates for the different taxes and what they stand to benefit if taxes are paid early. In addition to print and electronic media, social media is fast becoming a veritable source of information that the authorities could latch onto.

7. Provide a Simple Returns Process for Taxpayers

Many businesses make life easier for their customers by eliminating bottlenecks. In some instances, simple forms are filled out once, and the business will directly debit your bank account. Tax authorities need work to reduce the number of forms that taxpayers have to fill every year. As tax authorities, we can compress and consolidate the forms to obtain all relevant information rather than have several forms for different purposes.

8. Be Professional, Fair, and Transparent

Tax officers must act in a professional manner, and be fair and transparent in order to generate the highest level of trust among citizens, and get them to comply voluntarily with the tax laws. Tax officers should treat taxpayers with respect and make them know that they are partners in progress.

9. Civic-tax Education or Early Education

It is normal to consider taxation as an event that involves only adults who conduct a certain type of taxable activity. Therefore, young citizens would have no reason to be concerned over taxation, since they are totally excluded from the taxable event until they start to participate in economic activity. Therefore, the tax education of the younger citizens would be senseless according to this view. In societies that have reached a certain degree of development and wellbeing, the young start to make economic decisions as consumers of goods and services at an early age. Tax compliance is a behavior that adults shall incorporate without relying on an adequate education from an early age. Therefore, it is vital for the new generations that the tax behaviors be preceded by an awareness effort in the developmental stages, in order to make the young aware that their future prospects will be very different without the investment in equal opportunities implied by the citizens’ tax effort.

To achieve this, we can have:

Tax Clubs in our primary and secondary schools and Tax Departments in our tertiary institutions.

10. Use of IT Software

The tax authorities can collaborate and come up with software that helps taxpayers to compute their tax liability and file returns afterward. Such software may be downloaded from the internet or via the Apple or Google Play stores. Once completed using the software, taxpayers may either print out their returns and file them just like any other pre-defined model, or otherwise file them directly via the internet, and attach a digital signature that fully guarantees the security and confidentiality of the information supplied.

11. Simplify the Tax Law

Writing the tax law in layman’s language (simple English) and putting it in the major languages in Nigeria, for easy understanding and interpretation. This eradicates legal jargon that the ordinary man does not relate to.

Final Thoughts

Taxes are the dues that we pay for the privileges of membership in an organized society. – Franklin D. Roosevelt

0